-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

- Cosmetic Ingredient

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

On January 25th, the State Drug Administration issued the "Announcement on the Revision of the Gyfetinib Tablet Instructions", which stated that the "adverse reactions" and "precautions" description should be added to the jifeitinib instructions, and that the increased "adverse reactions" were mainly concentrated in the skin and sethic tissues. Abnormalities and other issues, and the "Precautions" to add serious adverse reactions (NCLCTCAE level 3 or above) need to suspend medication, during the use of drugs, skin sensation abnormalities, erythema, dew, blisters, bleeding and other adverse reactions timely medical content.

why drugs that have long dominated the anti-tumor field in small molecules now face safety questions, what's going on? Small molecule targeting drug - Gifeitinib's "pre-life" small molecule targeting drug is a special drug that actes on special cancer-causing site, identifying protein molecules or gene fragments inside cancer cells.

In the body, like a "missile", will automatically search for the target cancer cells, once found will automatically destroy the target, to achieve "precision strike" without harming innocent normal cells, so when targeting cancer cells on different organs, people often choose different targeted drugs.

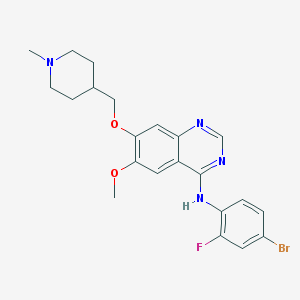

And gifactinib is one of them, it is selective skin growth factor inhibitor tyrosine kinase inhibitor (EGFR-TK), can hinder tumor growth, metastasis and angiogenesty, increase the apoptosis of cancer cells;

was first listed in 2002 and approved in China in 2005, because of its good efficacy and excellent safety, perennial occupies the small molecules targeted anti-tumor field of the "top three", AstraZeneatic monopoly in China's market for up to 11 years, the price has been as high as 5000 yuan / box.

The opportunities and challenges brought about by the great development of the anti-tumor field in recent years, with the rapid rise of the number of cancer patients in China, the anti-tumor drug market continues to expand, according to the PDB comprehensive database of drugs statistics (see Figure 1), since 2012, the anti-tumor drug market has maintained a strong growth of about 10%, of which the 2018-2019 growth rate reached a staggering 19.68 percent! The market size also reached 31.496 billion yuan, a record high.

Affected by the new crown epidemic in 2020, the total market value of Q1-Q3 is 22.601 billion yuan, with an estimated annual growth rate of about -4.71%, but in the context of the normalization of the epidemic, combined with the implementation of the volume procurement policy, China's anti-tumor drug field is expected to make great progress in 2021. figure

Figure 1 Anti-tumor drug sales and change trend chart of the entire anti-tumor drug market segmentation, can be divided into 5 major categories, namely, cancer drugs, anti-metabolic drugs, plant drugs, hormones, targeted small molecule drugs, currently accounting for about three quarters of the total market size, and targeted small molecule drug sales are soaring at an extremely rapid rate, according to P According to DB's Comprehensive Drug Database statistics (see Figure 2), sales increased from 1,867 million yuan in 2016 to 5,787 million yuan in 2020 (Q1-Q3), up from 8.2% in 2016 to 25.61% in 2020.

Figure 2 Pharmaceutical segment composition in the field of anti-tumor drugs according to the PDB drug comprehensive database statistics (see Figure 3), in the small molecular targeting drug family, we found that imatinib, giffeitinib and ecstasy in 2016, cumulative sales reached 1,155 million yuan, accounting for 61.8% of the entire family at that time! Over time, in 2019, the three Big Brother sales totaled 1,787 million yuan, a drop to 29%;

same time, in 2018, Oghidini's sales reached 1,004 million yuan, or 16.3% of the total, and by 2020, sales will not decline, surpassing 2019 sales in just three quarters, reaching a staggering 1,170 million yuan! More sales than Imatini, Gifeitini and Ektini combined! The proportion was as high as 20.2 per cent.

figure 3 Small molecule targeting drug family sales data map small molecule targeting drug field of "100 competing" small molecule targeting drug field fierce competition not only exists between varieties, in the sub-species, the major brands are also exhausted, competing for market share.

based on the PDB Comprehensive Drug Database, for example, gifeitinib (see figure IV).

4 In recent years, AstraZeneta's industry monopolist earned $297 million in revenue from the sales of various brands, and in 2017, Qilu Pharmaceuticals entered the market to compete with AstraZeneta. Market share, as of Q3 in 2020, AstraZeneone's market share in China fell to 76.14 per cent, with sales of just 187 million yuan, the lowest since entering China, as the overall competitiveness of the Gifeitini variety declined.

At the same time, China is also actively involved in other increasingly competitive tracks, Baiji Shenzhou's own research and development of anti-cancer drug Zebutini, on November 15, 2019, was approved by the U.S. FDA for listing, we are gradually close to the world's top level in drug research and development.

analysis and summary of the entire field of anti-tumor market continues to expand, for many years to maintain high-speed growth, cake is getting bigger and bigger at the same time, the market share of small molecule targeted drugs is also expanding, which fully demonstrates that its excellent results and good safety is changing the treatment of tumors.

In the context of double-good, industry prosperity, we looked deep into the small molecule targeting drug family, but found another scene, from 16 to 20 years, in less than four years, the industry's top three (Imatini, Gifeitini and Ektini) from the 60% market share, quickly slipped down the altar, 2020 total sales by the Ohidini family.

There are many reasons, including the growing human understanding of small molecule-targeted drugs, the best proof is the rapid iteration of the product, we have better methods and more experience to evaluate the safety and effectiveity of the drug, which is the fundamental reason why gifeitinib was ordered to modify adverse reactions and precautions.

followed by national volume procurement, "quantity-for-price" reduced the medical burden on people who had been taking anti-tumor drugs for a long time, while also contributing in part to a relative decline in sales of certain anti-tumor drugs.

with the progress of technology, I believe that tumors will gradually be overcome by modern medicine, the per capita cost of treatment will also be significantly reduced.

The current five-year survival rate and ten-year survival rate can be greatly improved if the tumor is detected in time and treated at an early stage, and hopefully in the near future, humans will no longer see the tumor as terminal and can really cure it."