-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

- Cosmetic Ingredient

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

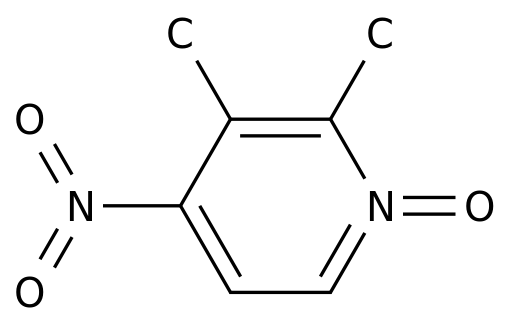

is preparing to buy a portion of IO's Arcus, but the details are not known. Arcus was founded a few years ago with the support of Flexus's original class of horses under major cancer giants such as Novarma and Xinji, with TIGIT antibody AB154 and several small molecule immunoactivation agents. Small molecules focus on the radon path, clinical projects include ATP, ADP hydrolyzed enzyme CD73 inhibitor AB680 and a subject A2A antagonist AB928. Arcus also has a PD-1 antibody, which may be a must-have for Gilead to truly compete with tumors. Arcus rose 51 percent after the news.Gilead's rapid depletion of the hepatitis C market has resulted in the main layout of NASH and tumors, but current progress has been limited. NASH's multiple-machine drugs have failed in a row, and cell therapy hasn't made much of a breakthrough since the $12 billion acquisition of Kite. Just a few weeks ago, for $4.9 billion, Fortyseven acquired CD47 antibody magolimab, and there is still some determination to enter the oncology market. But a previously unsalted antiviral drug, Redsyvir, has become a familiar drugmaker this year because of this year's new crown epidemic, but two randomized controlled trials of the drug in China have ended this week because of a recruitment challenge. Two Phase III clinics in the U.S. have also recently significantly increased the number of patients and altered clinical endpoints, making experts suspect limited efficacy. The new crown is likely to give more attention to antiviral drugs, and Gilead's return to the market as the most successful pharmaceutical company in the antiviral field should be a light ride.Flexus is a legend of IO therapy. Less than two years after Flexus was founded in 2014, the core product IDO inhibitors were acquired by Scudd for $1.25 billion before clinical trials, and are estimated to be still a record acquisition of preclinical small molecule drugs, becoming a landmark event in the IO bubble. Of course, later IDO inhibitors in echo301 failed to return to the world, Shi Guibao bought NKTR214 for 3.6 billion, last year simply bought a new base, continue to bet on immunotherapy. The old Flexus division, which created Arcus, now looks likely to be bought again at a high price. CEO Terry Rosen said at the time that immunotherapy was a unique and rare opportunity to double the gamble.Cells release more than normal levels of ATP under external forces such as hypoxia, and the immune system responds based on changes in ATP/tick balance. When activated, the A2A subject suppresses the immune response, so the subject antagonist relieves immunosuppression. CD73, CD39 inhibitors inhibit ATP degradation, reduce radon synthesis, and thus reduce immunosuppressive signals. This path was once an important direction for IO, and Corvus is another biotech company that developed the path through the drug, and its main product, ciforadenant (CPI-444), is now in Phase II Clinical. However, due to the combination of solid tumor and PD-L1 antibody phase I clinical failure to show synergy, so that investors' interest in this process greatly reduced. CD39, CD73 antibodies are also under development by several enterprises. AB154 is a checkpoint TIGIT inhibitor, and clinical trials in combination with PD-1 antibodies are now under way.Unlike any activated immune response asset in the Flexus era, the industry's expectations for immunotherapy are now much more sensible. After PD-1, TIM3, Lag3, IDO1, STING and other major hot targets into the clinic have not shown enough unilateral activity, not only IO this platform to produce unilateral drug capacity needs to be re-evaluated, combination therapy prospects are also dim. Magrolimab is one of the few successful drugs, although the clinical manifestations of other CD47 and its subject SIRPa antibodies are also very general. PD-1 is now seen as an extremely successful drug on a mediocre platform, and the return to the median over the past few years has been a painful process for many investors. Not only did the new IO drug show little apparent unilateral efficacy, but the combination therapy with the second IO drug CTLA4 antibody has largely failed, and even the PD-1 drug itself has been forced to flatten many times in confirmed trials after the market. Solid tumors also need to be eclecsy talent, can not completely pressure the treasure on immunotherapy. (

source of Chinese medicine in

)