-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

- Cosmetic Ingredient

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

Since February of this year, price increases from major chemical companies around the world have been coming in one after another.

Recently, many chemical giants such as BASF, Dow, DuPont, Toray, and Lanxess have sent letters to increase product prices.

The product supply area covers almost the world, and the price increase date has been arranged from early March to early April.

Product price increases of this scale have become a hot topic in the upstream and downstream industries of globalization, and have also brought tremendous pressure to downstream industries.

As the global new crown pneumonia epidemic eases and demand and demand expectations increase, commodity prices have begun to rise.

However, the recent cold wave in the United States has blocked the supply of chemical products in the United States, which has also pushed up the prices of chemical products.

In addition, from the feedback of some industry insiders, financial factors have also played a role in fueling the increase in product prices in this industry.

Product prices have risen across the board.

Recently, the prices of crude oil, the most upstream petrochemical industry, to bulk products such as plastics and synthetic rubber, and inorganic chemicals have been rising.

The prices of bulk chemicals such as ethylene, propylene, butadiene and pure benzene have hit record highs all over the world, which has caused the price of plastic raw materials to soar.

Among them, due to the dependence on imports of raw materials, European bulk chemicals have the most obvious global rise.

Since the end of last year, the prices of raw materials such as polyethylene and polypropylene in Europe have risen by 25% in a short period of time, reaching the highest level in the past six years.

On March 10, the European spot price of styrene in March reached US$2400-2600/ton, up 225% from the same period last year.

In Asia, many products have also risen to new highs.

For example, the price of PX in Asia hit a 21-month high, reaching 895.

83 US dollars/ton; the price of bisphenol A soared to historical highs, and the current price has reached 2800~3000 US dollars/ton.

In China, the prices of almost all plastic grades have risen sharply since the beginning of this year.

In terms of inorganic chemicals, the prices of products such as carbon black, titanium dioxide, nitrogen fertilizer, phosphate fertilizer and calcium carbide have all increased significantly from the beginning of the year.

Many international companies have issued price increase letters several times this year, covering markets all over the world.

Take BASF as an example.

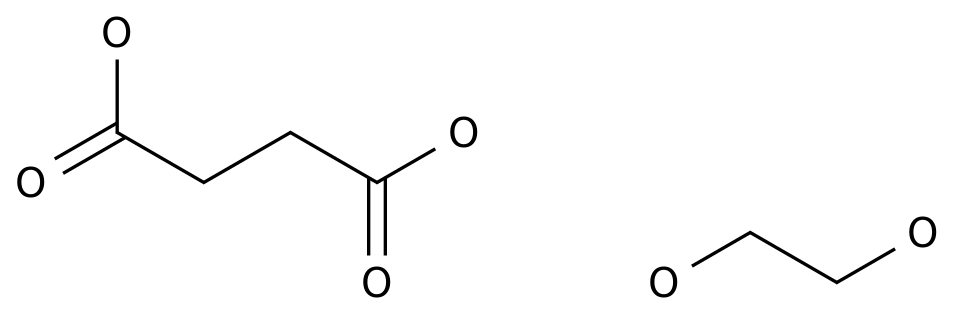

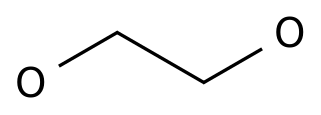

Since February this year, the company has separately adjusted its biodegradable compounds ecovio, Asia-Pacific PBT (polybutylene terephthalate), PA66, and European BDO (1,4-butadiene).

, THF (tetrahydrofuran), the price of American TDI (toluene diisocyanate) and other products; Carbon black giant Cabot raised its Asian carbon black product prices by 10% and North American product prices by 25%.

In addition, DuPont, DSM, Teijin, Toray, LANXESS, Ineos and other companies have all raised the prices of some of their products, and at least more than 20 plastics and chemical industry giants have announced product price increases.

The imbalance between supply and demand drives up prices.

Although a variety of factors have caused the current global chemical prices to rise, the main reason is still the imbalance between supply and demand.

In terms of demand, as the global new crown pneumonia epidemic has slowed down, the end industry demand has been significantly boosted.

However, due to various reasons, the supply cannot meet the downstream demand, which is the main reason for the price increase of chemical products.

Recently, the severe shutdown of local oil refining and chemical companies caused by extreme cold weather in Texas, the United States, is the main factor causing the shortage of supply.

Under the cold wave, the U.

S.

plastics chemical market's production capacity has dropped sharply.

A number of chemical giants announced force majeure shutdowns.

Chemical companies such as DuPont, DSM, and Covestro even announced extensions of delivery for up to 84 days.

Due to the particularity of chemical production, it will take a long time for chemical manufacturers to completely eliminate the impact of freezing on various equipment and resume work safely after they have stopped due to freezing.

Industry insiders analyze that the entire plastics chemical industry will recover from freezing and its impact on the supply chain backlog.

It is expected that it will not be realized until the second quarter of 2021.

If you consider transportation and other factors, the impact of the shutdown of the US chemical industry is even more profound.

In addition to the impact on the chemical industry, the cold wave has also severely hit power transmission and transportation in Texas.

Electricity shortages and the priority restoration of civilian power in Texas have caused a shortage of electricity in the chemical industry.

First, traffic disrupted product transportation and caused logistics congestion, making this crisis difficult to resolve in a short time.

Sven Arnold, senior analyst for the European plastics industry: "This year, the first batch of plastic raw materials from the United States may arrive in Europe in June and July, and the supply of plastic raw materials in Europe will not return to normal levels before the epidemic at the earliest by the end of this year.

In addition, the new crown pneumonia epidemic still has a negative impact on supply recovery.

Due to the relative lag in vaccination, many chemical companies in Europe are still unable to take up their jobs.

This is bound to affect the fundamentals of the chemical industry, which is in short supply.

The financial factors fueling the flames are the same as the large-scale price increases in history, and financial factors have had an impact on the current price increases.

As one of the most important futures, the current rise in crude oil futures prices is significantly affected by financial factors.

At the recent OPEC+ oil-producing countries meeting, OPEC Chairman Barkindu said that with the current increase in crude oil prices, the improvement in supply and demand is only one aspect, but financial market participation and speculation It is also a factor that cannot be ignored.

In addition, the US$1.

9 trillion fiscal stimulus policy and its inflation expectations have stimulated financial enthusiasm for investment in the commodity market.

Under this circumstance, chemical bulk products are naturally inevitable, and they have to go in the direction of soaring prices.

For the future development, the expectations given by financial investment institutions and professional institutions are very different.

Take crude oil as an example.

Almost all investment institutions are optimistic about the growth of oil demand this year, but professional institutions are even more pessimistic.

Last week, due to pessimistic expectations of improvement in supply and demand, OPEC members did not relax production cuts as predicted by financial institutions, and the U.

S.

Energy Information Administration (EIA) even lowered its 2021 global oil demand forecast.

Recently, many chemical giants such as BASF, Dow, DuPont, Toray, and Lanxess have sent letters to increase product prices.

The product supply area covers almost the world, and the price increase date has been arranged from early March to early April.

Product price increases of this scale have become a hot topic in the upstream and downstream industries of globalization, and have also brought tremendous pressure to downstream industries.

As the global new crown pneumonia epidemic eases and demand and demand expectations increase, commodity prices have begun to rise.

However, the recent cold wave in the United States has blocked the supply of chemical products in the United States, which has also pushed up the prices of chemical products.

In addition, from the feedback of some industry insiders, financial factors have also played a role in fueling the increase in product prices in this industry.

Product prices have risen across the board.

Recently, the prices of crude oil, the most upstream petrochemical industry, to bulk products such as plastics and synthetic rubber, and inorganic chemicals have been rising.

The prices of bulk chemicals such as ethylene, propylene, butadiene and pure benzene have hit record highs all over the world, which has caused the price of plastic raw materials to soar.

Among them, due to the dependence on imports of raw materials, European bulk chemicals have the most obvious global rise.

Since the end of last year, the prices of raw materials such as polyethylene and polypropylene in Europe have risen by 25% in a short period of time, reaching the highest level in the past six years.

On March 10, the European spot price of styrene in March reached US$2400-2600/ton, up 225% from the same period last year.

In Asia, many products have also risen to new highs.

For example, the price of PX in Asia hit a 21-month high, reaching 895.

83 US dollars/ton; the price of bisphenol A soared to historical highs, and the current price has reached 2800~3000 US dollars/ton.

In China, the prices of almost all plastic grades have risen sharply since the beginning of this year.

In terms of inorganic chemicals, the prices of products such as carbon black, titanium dioxide, nitrogen fertilizer, phosphate fertilizer and calcium carbide have all increased significantly from the beginning of the year.

Many international companies have issued price increase letters several times this year, covering markets all over the world.

Take BASF as an example.

Since February this year, the company has separately adjusted its biodegradable compounds ecovio, Asia-Pacific PBT (polybutylene terephthalate), PA66, and European BDO (1,4-butadiene).

, THF (tetrahydrofuran), the price of American TDI (toluene diisocyanate) and other products; Carbon black giant Cabot raised its Asian carbon black product prices by 10% and North American product prices by 25%.

In addition, DuPont, DSM, Teijin, Toray, LANXESS, Ineos and other companies have all raised the prices of some of their products, and at least more than 20 plastics and chemical industry giants have announced product price increases.

The imbalance between supply and demand drives up prices.

Although a variety of factors have caused the current global chemical prices to rise, the main reason is still the imbalance between supply and demand.

In terms of demand, as the global new crown pneumonia epidemic has slowed down, the end industry demand has been significantly boosted.

However, due to various reasons, the supply cannot meet the downstream demand, which is the main reason for the price increase of chemical products.

Recently, the severe shutdown of local oil refining and chemical companies caused by extreme cold weather in Texas, the United States, is the main factor causing the shortage of supply.

Under the cold wave, the U.

S.

plastics chemical market's production capacity has dropped sharply.

A number of chemical giants announced force majeure shutdowns.

Chemical companies such as DuPont, DSM, and Covestro even announced extensions of delivery for up to 84 days.

Due to the particularity of chemical production, it will take a long time for chemical manufacturers to completely eliminate the impact of freezing on various equipment and resume work safely after they have stopped due to freezing.

Industry insiders analyze that the entire plastics chemical industry will recover from freezing and its impact on the supply chain backlog.

It is expected that it will not be realized until the second quarter of 2021.

If you consider transportation and other factors, the impact of the shutdown of the US chemical industry is even more profound.

In addition to the impact on the chemical industry, the cold wave has also severely hit power transmission and transportation in Texas.

Electricity shortages and the priority restoration of civilian power in Texas have caused a shortage of electricity in the chemical industry.

First, traffic disrupted product transportation and caused logistics congestion, making this crisis difficult to resolve in a short time.

Sven Arnold, senior analyst for the European plastics industry: "This year, the first batch of plastic raw materials from the United States may arrive in Europe in June and July, and the supply of plastic raw materials in Europe will not return to normal levels before the epidemic at the earliest by the end of this year.

In addition, the new crown pneumonia epidemic still has a negative impact on supply recovery.

Due to the relative lag in vaccination, many chemical companies in Europe are still unable to take up their jobs.

This is bound to affect the fundamentals of the chemical industry, which is in short supply.

The financial factors fueling the flames are the same as the large-scale price increases in history, and financial factors have had an impact on the current price increases.

As one of the most important futures, the current rise in crude oil futures prices is significantly affected by financial factors.

At the recent OPEC+ oil-producing countries meeting, OPEC Chairman Barkindu said that with the current increase in crude oil prices, the improvement in supply and demand is only one aspect, but financial market participation and speculation It is also a factor that cannot be ignored.

In addition, the US$1.

9 trillion fiscal stimulus policy and its inflation expectations have stimulated financial enthusiasm for investment in the commodity market.

Under this circumstance, chemical bulk products are naturally inevitable, and they have to go in the direction of soaring prices.

For the future development, the expectations given by financial investment institutions and professional institutions are very different.

Take crude oil as an example.

Almost all investment institutions are optimistic about the growth of oil demand this year, but professional institutions are even more pessimistic.

Last week, due to pessimistic expectations of improvement in supply and demand, OPEC members did not relax production cuts as predicted by financial institutions, and the U.

S.

Energy Information Administration (EIA) even lowered its 2021 global oil demand forecast.