-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

- Cosmetic Ingredient

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

Etsy August 12, 2019, Hansen Corporation releases second quarter 2019 results: July 1, the Company successfully completed balance sheet deleveraging and reduced total consolidated debt by more than $2 billion; $9.2 billion, down 10 per cent from the previous year, net loss of $107 million, including restructuring charges of $156 million, and pre-tax, depreciation and amortisation profit of $112 million, down 13 per cent from a year earlier.

net sales for the quarter to June 30, 2019 were $892 million, down 10 percent from $995 million a year earlier. Profit before interest, tax, depreciation and amortization was $112 million, down $16 million from a year earlier, partially offset by cost

-cutting actions, driven by the company's underlying epoxy and global forest

.

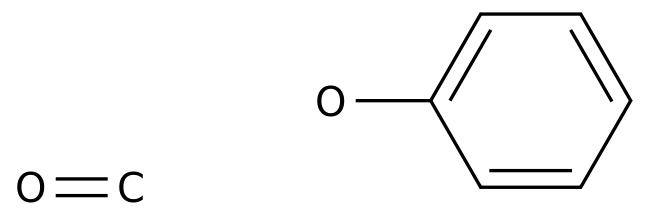

epoxy, phenolic and coating resins reported net sales of $512 million in the second quarter of 2019, down 9% from $564 million in the second quarter of 2018. Pricing negatively impacted net sales of $24 million, primarily due to lower margins due to weak market conditions in our underlying epoxy business compared to the second quarter of 2018. Foreign currency conversion had a negative impact on sales of $21 million. These declines were partially offset by an increase in our specialty epoxy business due to strong wind energy demand in China. Earnings before interest, tax, depreciation and amortization of epoxy, phenolic and coating resins were $59 million, down 18% from $72 million in the second quarter of 2018.

craig A. Rogerson, chairman and chief executive officer of the Company," said: "We are pleased to usher in a new era for Hansen by rapidly and successfully completing the balance sheet restructuring. "Our new capital structure provides us with a strong financial foundation for our continued operations and development of our specialty chemical portfolio. As an appropriate capitalized market leader with significant free cash flow generation capabilities and a low interest burden, we can take full advantage of our leading market position, global manufacturing footprint and professional portfolio. We thank our creditors for their support throughout the process, as well as our valued customers, suppliers and employees. Mr

Rogerson added: "In the second quarter of 2019, our underlying epoxy, Versatic Acids™ and forest products businesses reflected weaker earnings, partially offset by improved specialty epoxy results, reflecting positive wind energy demand. Despite the weak market environment in some end markets, we continue to focus our company on stronger quarterly and long-term success, as well as strategically investing in our business, such as our new application development center in Shanghai, which is expected to open until the end of 2019, and we will continue to look for ways to streamline our business, most recently identifying and implementing the new cost savings we expect to achieve over the next 18 months. In

of 2019

the company achieved $7 million in cost savings related to the restructuring plan. In addition, Hansen recently identified additional cost savings of approximately $20 million, mainly related to lower sales, general and administrative costs. On June 30, 2019, Hansen made approximately $23 million in savings in the process, which is expected to be realized over the next 18 months.

successfully completed the balance sheet

on July 1, 2019, Hansen successfully completed the balance sheet deleveraging. As a result of this process, Hansen has reduced its debt by more than $2 billion, provided rights through an injection of $300 million in equity capital and raised about $2 billion in exit financing. Throughout the bankruptcy court oversight process, Hansen's global operations continue to provide customers with high-quality products and services. The deleveraging plan provides for full payment to the company's trading creditors.

capital resources, Hansen'

total debt as of June 30, 2019 was approximately $3.9 billion. Following the capital structure refinancing as of July 1, 2019, the Company's total provision obligations as of June 30, 2019 were approximately $1.8 billion, primarily including approximately $1.2 billion in senior secured term loans for 2026. and $450 million in preferred notes due in 2027. In addition, as of June 30, 2019, the Company had $418 million in liquidity.