Performance soared by 145%. Corway is expected to exceed the scale of 10 billion

-

Last Update: 2020-01-14

-

Source: Internet

-

Author: User

Search more information of high quality chemicals, good prices and reliable suppliers, visit

www.echemi.com

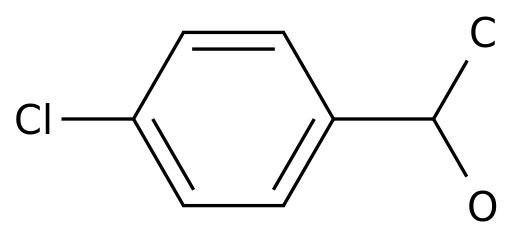

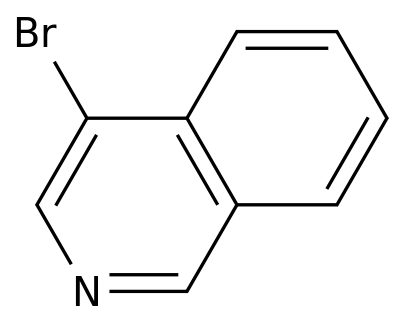

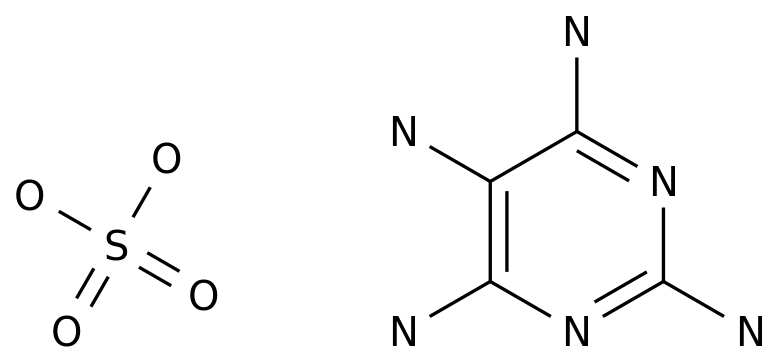

Recently, dongyangyao released its 2019 performance forecast, and its annual revenue is about 6.22 billion yuan, an increase of about 145% over the previous year Driven by five factors, corway is expected to exceed the scale of 10 billion At present, the company has 34 generic drugs reported for production, 22 of which have been approved for listing in the United States or the European Union, and 8 varieties are the first to be imitated Among the 9 varieties, 5 are exclusive In the next two years, there will be more than 35 varieties The distribution of new drugs in antiviral, diabetes and other fields is worth looking forward to On January 2, dongyangyao announced that, based on the current available unaudited comprehensive management accounts and the preliminary estimates of the company's management, it is estimated that the company's turnover in 2019 will be about 6.22 billion yuan, an increase of about 145% over the previous year, of which the turnover in the fourth quarter will be about 1.78 billion yuan, an increase of about 125% over the same period last year According to Dongyang Guangyao, one of the main reasons for the company's performance growth is the continuous growth of core product sales volume Every year, December, January and February are the period of influenza outbreak According to the data of China influenza monitoring weekly released by the National Influenza Center, after November 2019, the level of influenza activity in China gradually increased, and in December, it entered the outbreak period The outbreak of winter influenza made the sales volume of corway increase sharply in the fourth quarter of 2019 As a result, dongyangyao achieved a single quarter operating revenue of about 1.78 billion yuan Figure 1: 2016-2019 (H1) dongyangguang pharmaceutical and its revenue (unit: 100 million yuan) According to the annual report data of dongyangyao, in recent years, the company's revenue shows a rapid growth trend, with the growth rate of 35.88% in 2016, 70.11% in 2017, 56.75% in 2018, 145% in 2019, and 100% for the first time This is mainly due to the continuous and rapid production of the company's key products In 2019, H1 dongyangguang pharmaceutical achieved a revenue of 3.071 billion yuan, of which 2.93 billion yuan was from kerway, accounting for 95.41% of the total revenue Based on the annual revenue of 6.22 billion yuan (Unaudited), the revenue of H2 company in 2019 is about 3.149 billion yuan, of which Q3 revenue is about 1.369 billion yuan and Q4 revenue is about 1.78 billion yuan According to the data of mienei.com, in 2019, the terminal sales volume of public hospitals in key provinces and cities in Q3 increased by 48.15% over the same period last year Based on the proportion of revenue of the company in previous years, it is estimated that the sales revenue of the company will exceed 5.5 billion yuan in 2019 The growth of corway's sales mainly comes from the high incidence of influenza, the nationwide popularity of influenza treatment concept and the gradual implementation of oseltamivir as a first-line treatment scheme Based on the following factors, in the future, corway will continue to maintain its growth momentum, or is expected to exceed the scale of 10 billion yuan: 1 The promotion of professional academic market continues to strengthen and the penetration rate of medical institutions across the country continues to increase In 2018, Kewei granules covered 1552 Level 3 hospitals and 6737 Level 2 hospitals, while Kewei capsules covered 1243 Level 3 hospitals and 4028 Level 2 hospitals; 2 The grass-roots market has made great achievements By the end of 2018, the coverage rate of corway in the primary market is only about 3% After being selected into the 2018 new basic drug catalog, it is expected to open the door of the primary medical institution market and improve the coverage rate of corway in the primary market; 3 It is expected that the amount of medical insurance will be increased after it is released In the 2019 new version of the medical insurance catalogue, oseltamivir phosphate capsule is "limited to the treatment of severe influenza high-risk groups and patients with severe influenza", oseltamivir phosphate granules is "limited to children who are not suitable to use oseltamivir oral regular release dosage forms or patients with dysphagia", the new version of the medical insurance catalogue is limited to oseltamivir, and Kewei is expected to release more in the future; 4 The sales channels are constantly expanding In November, December, 2019 and January, 2020, dongyangyao successively signed strategic cooperation agreements with Jiuzhoutong, yiyao.com, Ali health and China Resources pharmaceutical, developed new channels such as Internet and OTC, strengthened Kewei's response to sudden national demand, and improved brand awareness and market share; 5 In a short period of time, the impact of competitive products is weak At present, only 3 pharmaceutical companies (original research manufacturers + 2 domestic pharmaceutical companies) in the domestic market have production approval documents of oseltamivir The advantages of the exclusive granule type and the only evaluated product of dongyangyao are obvious Due to the lack of competitive products, there will be no sharp price reduction in the short term Roche's imported 5.1 influenza new drug baloxavir marboxil tablet was approved for clinical use by the end of 2018 Zhongsheng pharmaceutical's 1 influenza new drug zsp1273 tablet is in phase II clinical use (the indication is influenza A) It is still a while before it is officially put on the market Table 1: generic drugs applied for listing in China by dongyangyao At present, 34 generic drugs of Dongyang Guangyao have been declared for listing in China, 22 of which have been approved for listing in the United States or the European Union; 34 varieties have been submitted for listing application according to the new registration classification or reviewed according to the new registration classification, and they are deemed to pass the consistency evaluation after being approved for production From the approved situation, five varieties of clarithromycin sustained-release tablets, clarithromycin tablets, levofloxacin tablets, moxifloxacin hydrochloride tablets and olmesartan ester tablets have been approved for production, which are deemed to have passed the consistency evaluation Among them, olmesartan ester tablet is the first one, clarithromycin sustained-release tablets, clarithromycin tablets and levofloxacin tablets are the exclusive ones In addition to the above five varieties deemed to have been evaluated according to the new registration classification, four varieties of dongyangguang medicine have applied for additional evaluation through consistency evaluation, namely, benbromarone tablet, amlodipine besylate tablet, fordostan tablet and oseltamivir phosphate capsule, among which benbromarone tablet and oseltamivir phosphate capsule are the exclusive ones In the next two years, more than 35 varieties will pass the consistency evaluation, Dongyang said 18 of the 34 varieties have been included in the priority review, all of which are produced on the same production line, and have been approved for listing in the EU or the United States It can be seen that "foreign reporting to China" can not only accelerate the approval for listing of dongyangyao's generic products, but also become an indispensable help for the domestic consistency evaluation of the company's layout Table 2: no first approved varieties Note: declaration enterprises are arranged from front to back according to application time Eight of the 34 varieties haven't been imitated for the first time, among which the products of esmeralazole magnesium enteric coated capsules haven't been approved for marketing At present, only the products of the original manufacturers are in China Marketing The first imitation of propofol-tenofovir fumarate tablets and cigliptin phosphate tablets is more fierce At present, there are 10 imitations of propofol-tenofovir fumarate tablets, including Zhengda Tianqing, Qilu, etc.; 8 imitations of Sichuan Kelun, Zhengda Tianqing, etc., apply for listing of cigliptin phosphate tablets Esomeprazole magnesium enteric coated capsules, entacapone tablets, liggliptin tablets, liggliptin metformin tablets, and siggliptin metformin tablets are the first to submit an application for listing by dongyangyao, which is expected to be the first to be approved Figure 2: Top 5 manufacturers of systemic antiviral drugs for public hospitals in key provinces and cities in 2014-2019 (first three quarters) In 2016, Zhengda Tianqing began to "dominate" the whole-body antiviral drug market by virtue of anti hepatitis B drug entecavir At the end of 2018, the first batch of national centralized procurement was implemented Entecavir was included in the market, and the price dropped significantly In the first three quarters of 2019, the market share of Zhengda Tianqing in the end of public hospitals in key provinces and cities dropped significantly, while that of dongyangguang drug rose all the way by virtue of anti influenza drug oseltamivir, It's the same as Zhengda At present, the first class 1 new anti hepatitis C drug, imitavir phosphate capsule, of dongyangyao, has been declared for market Another new anti hepatitis C drug, imitavir phosphate + vorarevir combination therapy, which has been cooperated with Taijing, has started phase III clinical trials and is expected to submit for market application in 2020 Mofetidine, a new anti hepatitis B drug, can inhibit cccDNA, which is an indispensable target for hepatitis B cure It is expected to apply in 2022 Please go to the market.. As more and more new anti hepatitis drugs are approved to go on the market, the leading position of dongyangyao in the field of systemic antiviral will be more and more stable Figure 3: pattern of terminal diabetes drug manufacturers in public hospitals of key provinces and cities in the first three quarters of 2019 According to the diabetes map data of the International Diabetes Union, China's diabetes patients currently rank the first in the world, and it is expected to reach 151 million by 2040 There is still a huge potential demand for diabetes drugs in China In the first three quarters of 2019, in the competition pattern of public hospitals in key provinces and cities, the three giants of Novo Nordisk, Sanofi and Bayer occupy nearly half of the market share, and there is still a large space for domestic pharmaceutical enterprises to play Table 3: sugar reducing products under research of dongyangyao At present, dongyangyao has established a complete R & D system for insulin series products, the product line covers the second and third generations of insulin, the recombinant human insulin injection has submitted an application for listing, and the Protamine Recombinant Human Insulin Injection (premixed 30R), glargine insulin injection and aspart insulin 30 injection have entered the phase III clinical trial stage In terms of non insulin hypoglycemic drugs, dongyangyao has a layout on sglt-2, GLP-1, DPP-4 and other hot research and development targets The first class of new drug, ronggliclazin pyroglutamate, has been in clinical phase III, lilaluptide injection has been approved for clinical use, and generic drugs such as liggliptin tablets and xigliptin phosphate tablets have been put on the market As the "first brother of influenza" in China, covey is bound to face the impact of generic drugs and other new target influenza drugs in the future On the one hand, dongyangyao not only intensifies market promotion and channel expansion, but also deepens the core value of Covey On the other hand, it also enriches NEW drug research and development pipelines in anti-virus, anti-tumor, diabetes and other fields through external acquisition and independent research and development, with new growth The layout of points is worth looking forward to!

This article is an English version of an article which is originally in the Chinese language on echemi.com and is provided for information purposes only.

This website makes no representation or warranty of any kind, either expressed or implied, as to the accuracy, completeness ownership or reliability of

the article or any translations thereof. If you have any concerns or complaints relating to the article, please send an email, providing a detailed

description of the concern or complaint, to

service@echemi.com. A staff member will contact you within 5 working days. Once verified, infringing content

will be removed immediately.