-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

- Cosmetic Ingredient

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

On Thursday, the Shanghai rubber RU2109 contract opened low and fluctuated, and the futures price closed slightly lower

.

The current price closed at 13665, -0.

65% from the previous trading day; Deals 559661, open 242532 lots, -574, basis -465; RU9-1 spread -1155.

The NR2108 contract closed at 11215, -0.

84% from the previous session; Volume 11033 lots, position volume 21845 lots, +2158; NR07-08 spread -135

.

News: 1.

The United States increased the number of

rubber imports from Vietnam in the first quarter.

2.

Thailand's export volume of tianjiao in April increased by 34% year-on-year and decreased by 20%

month-on-month.

3

.

The U.

S.

Department of Commerce released the final ruling results of the "double reverse" tire ruling on South Korea, Taiwan, Thailand and Vietnam.

Market quotation: Shanghai market 19 years state-owned full latex reported 13200 (-50) yuan / ton, Vietnam 3L reported 13000 (-50) yuan / ton, Thailand No.

3 tobacco film reported 19900 (-50) yuan / ton

.

Qingdao market STR20 stock spot reported 1715 (+5) US dollars / ton, Qingdao market STR20 June cargo reported 1715 (+10) US dollars / ton

.

Hainan state-owned glue into the whole dairy plant 13000 (+0) yuan / ton, into the concentrated milk plant 13800 (+0) yuan / ton

.

The purchase price of glue of dry rubber factory in Mengla area of Yunnan refers to 13-13.

3 yuan / kg, and the purchase price of glue of concentrated dairy plant refers to 13.

3-13.

5 yuan / kg

.

Thailand Hat Yai raw material market field glue 63.

5 (-1.

5) baht/kg; Cup glue 46.

15 (+0.

15) baht/kg

.

Synthetic rubber: Qilu petrochemical styrene-butadiene rubber 1502 in North China market price 12700 (+0) yuan / ton; The market price of cis-butadiene rubber is 12200 (+0) yuan / ton

.

Warehouse receipt inventory: RU warehouse receipt 176490 tons, +0 tons; NR warehouse receipt 54564 tons, + 1008 tons

.

Main positions: RU2109 Top 20 Long Positions 108813, -775; Short Positions 163207, +1148;

Summary: At present, the main producing areas at home and abroad have been cut one after another, the upper volume in southern Thailand and Yunnan production areas is not as expected, coupled with the increase in rainfall in Yunnan and northern Thailand, raw material prices remain firm; The output of Hainan production area increased rapidly, but the recent high temperature and secondary budding of gum trees affected the output, the price of raw materials continued to rise, the demand for concentrated milk improved, the price difference between glue into latex factory and whole dairy plant widened, and whole milk raw materials

were squeezed again.

In terms of inventory, as of the week of May 23, China's natural rubber social inventory continued to decline week-on-week, Qingdao's general trade inventory digestion exceeded expectations, and the speed of warehouse reduction increased

.

On the demand side, Europe has turned around significantly, the easing of lockdown measures is expected to heat up, and overseas tire factories continue to recover, but it also squeezes China's tire export demand

.

Environmental factors, some factories in Dongying, Shandong Province stopped production and limited production, and the operating rate of domestic tire factories fell month-on-month last week, but this will ease inventory pressure

to a certain extent.

As the temperature gradually rises, the demand for truck and bus replacement market is expected to recover, and domestic sales are expected to improve

.

On the market, the RU2109 contract fluctuates in a narrow range, focusing on the support around 13500 in the short term, and it is recommended to trade in the 13500-13850 range; The NR2108 contract is recommended to trade

in the 11100-11600 range.

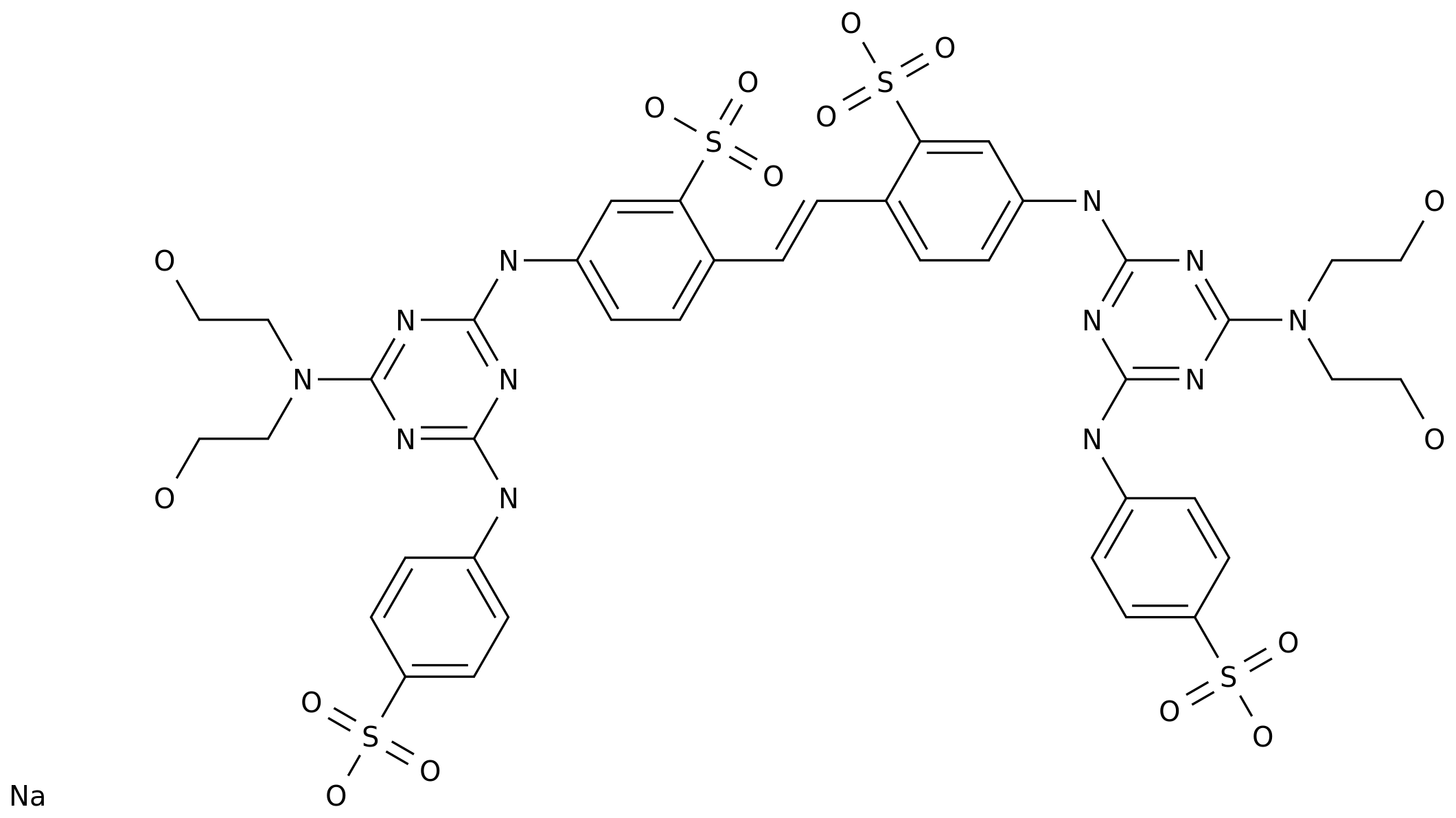

![disodium 4,4'-bis[[4-anilino-6-[(2-carbamoylethyl)(2-hydroxyethyl)amino]-1,3,5,-triazin-2-yl]amino]stilbene-2,2'-disulphonate CAS NO 27344-06-5](https://file.echemi.com/fileManage/upload/cas/77/e1abc71f-648d-403c-93fe-69b5c9401d56.gif)