-

Categories

-

Pharmaceutical Intermediates

-

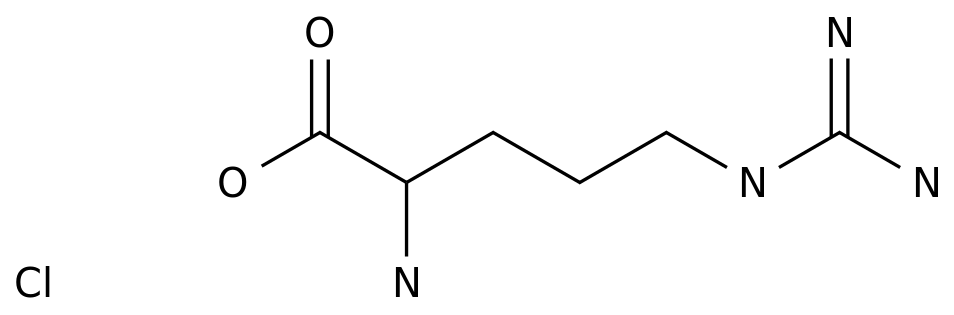

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

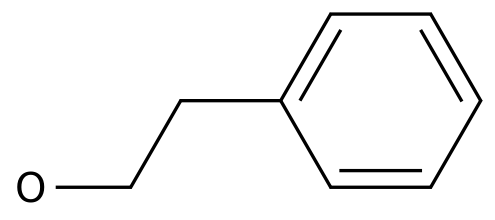

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

- Cosmetic Ingredient

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

Our reporter Wang Jinchen

On July 15, Shanghai Baoli Food Technology Co.

The prospectus shows that Baoli Foods has continued to improve its operating performance in recent years

It is worth noting that Baoli Foods has weak solvency and the risk of collection of accounts receivable

In addition, Baoli Foods also relies on a single customer

In order to reduce the risk of relying on a single customer, Baoli Foods has continuously expanded its light cooking solutions and beverage and dessert ingredients business in recent years.

Rapid revenue growth Accounts receivable higher than net profit risk

According to public information, Baoli Foods’ main business is the research and development, production and technical services of food seasonings.

On July 1, 2021, Baoli Foods officially submitted the prospectus to the Shanghai Stock Exchange, and the first meeting was held on May 26, 2022.

Baoli Foods has grown rapidly in recent years

Although Baoli Foods' operating performance has continued to improve in recent years, its asset-liability ratio and accounts receivable balance are still at a relatively high level

Baoli Foods said that the asset-liability ratio is higher than that of the same industry, mainly due to the continuous growth of its business scale

It is worth mentioning that Yum China (hereinafter referred to as "Yum") accounted for the highest proportion of Baoli Food's accounts receivable.

Revenue depends on a single customer, business transformation has achieved initial results

In the early days of its establishment, Baoli Foods mainly provided powder-based compound seasonings such as breadcrumbs, bread crumbs and seasoning powder for the upstream chicken processing manufacturers of KFC, with relatively single product types

Although Yum! provides a stable downstream market for Baoli Foods, it also has the risk of relying on a single customer and is subject to certain restrictions

The sales price and gross profit margin of Baoli Foods' compound seasonings have also been declining year after year.

Key customer dependence is not uncommon among catering brand suppliers

Previously, Baoli Foods mainly sold customized products to customers.

According to the data, from the end of June 2019 to the end of 2021, the revenue of Baoli Foods compound seasoning accounted for about 78.

47%, 72.

78% and 57.

67% of the main business revenue, a decrease of 20.

80 percentage points in three years

.

The proportion of light cooking solutions and beverage and dessert ingredients in the main business revenue will increase from 21.

53% in 2019 to 46.

29% in 2021

.

The main reason for the change in the business structure of Baoli Foods is that it acquired a 75% stake in Kitchen Affin in March 2021, and created the Internet celebrity brand Kongji noodles

.

In 2020, the brand brought 68.

26 million yuan of operating income to Baoli Foods, which has increased to 180 million yuan by the end of June 2021

.

In addition, in order to diversify its product and customer structure, Baoli Foods has also launched its own compound seasoning brand "Baoli Kezi", which is sold in a distribution model

.

However, due to the immature dealer system and low brand influence, the revenue of "Bao Li Kezi" is relatively low, and the brand influence facing end consumers still needs to be improved

.

Responsible editor: Zhao Yu Review: Peng Zonglu