-

Categories

-

Pharmaceutical Intermediates

-

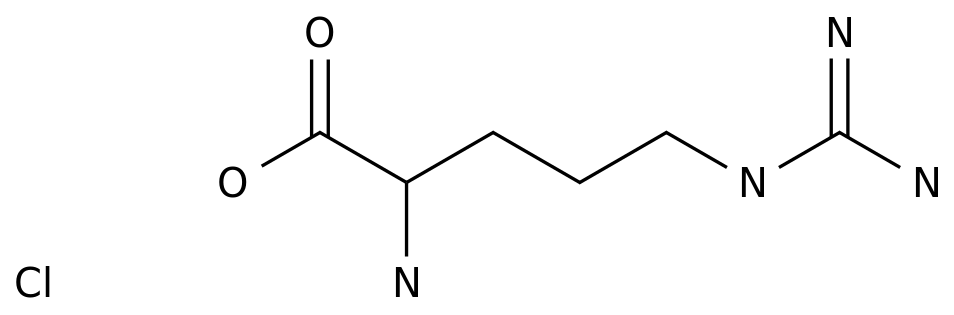

Active Pharmaceutical Ingredients

-

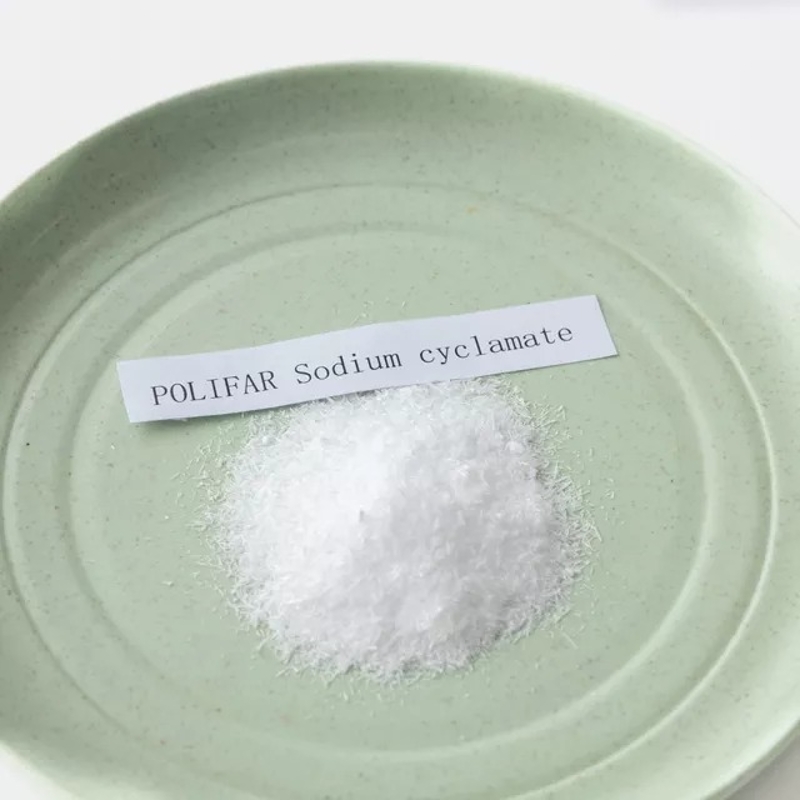

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

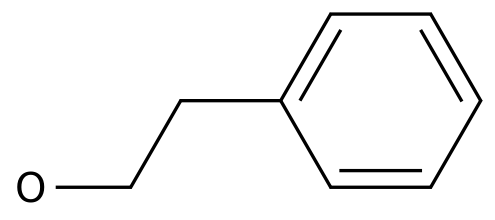

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

- Cosmetic Ingredient

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

The FAO Food Price Index measures the monthly changes in the price of a basket of cereals, oilseeds, dairy products, meat and sugar.

Last month the index averaged 124.

6 points, although it was lower than the revised May index of 127.

8 (previously 127.

1).

But it is still 33.

9% higher than in June 2020

.

Last month the index averaged 124.

6 points, although it was lower than the revised May index of 127.

8 (previously 127.

1).

But it is still 33.

9% higher than in June 2020

.

The FAO vegetable oil price index fell 9.

8% in June, partly because of falling palm oil prices

.

The expected increase in palm oil production in major producing countries, coupled with the lack of new import demand, puts palm oil prices under pressure

.

Soybean oil and sunflower oil prices also fell

.

8% in June, partly because of falling palm oil prices

.

The expected increase in palm oil production in major producing countries, coupled with the lack of new import demand, puts palm oil prices under pressure

.

Soybean oil and sunflower oil prices also fell

.

The FAO Grain Price Index fell 2.

6% month-on-month in June, but rose 33.

8% year-on-year

.

Among them, corn prices fell 5% month-on-month, partly due to higher-than-expected yields in Argentina and improved crop conditions in the US

.

Global rice prices fell in June, hitting a 15-month low, as high freight rates and shortage of container supplies continued to restrict export sales

.

6% month-on-month in June, but rose 33.

8% year-on-year

.

Among them, corn prices fell 5% month-on-month, partly due to higher-than-expected yields in Argentina and improved crop conditions in the US

.

Global rice prices fell in June, hitting a 15-month low, as high freight rates and shortage of container supplies continued to restrict export sales

.

The sugar index rose by 0.

9% month-on-month in June, the highest level since March 2017

.

Brazil, the world's largest sugar exporter, has unfavorable weather and uncertainty about its impact on crop yields, triggering sugar prices to rise

.

9% month-on-month in June, the highest level since March 2017

.

Brazil, the world's largest sugar exporter, has unfavorable weather and uncertainty about its impact on crop yields, triggering sugar prices to rise

.

The meat price index rose by 2.

1% month-on-month in June.

All meat prices rose because of the increase in imports from some East Asian countries, which made up for the slowdown in China's meat imports

.

1% month-on-month in June.

All meat prices rose because of the increase in imports from some East Asian countries, which made up for the slowdown in China's meat imports

.

The price of dairy products fell by 1% from the previous month, and the prices of all products in the index fell

.

Among them, butter fell the most because of the rapid decline in global import demand and the small increase in inventories, especially in Europe

.

.

Among them, butter fell the most because of the rapid decline in global import demand and the small increase in inventories, especially in Europe

.

Rome-based FAO also stated in a statement that global cereal production in 2021 will be close to 2.

817 billion tons, slightly lower than earlier expectations, but it is still expected to set a record high

.

The main reason for the slight downward revision of the grain production forecast is that the continued dry weather in Brazil has affected the yield potential of the second crop of maize, which has led to a sharp decline in the production of maize in Brazil

.

817 billion tons, slightly lower than earlier expectations, but it is still expected to set a record high

.

The main reason for the slight downward revision of the grain production forecast is that the continued dry weather in Brazil has affected the yield potential of the second crop of maize, which has led to a sharp decline in the production of maize in Brazil

.

This month's global wheat production forecast data is also slightly lowered, because the dry weather in the Near East has harmed the local wheat yield potential

.

In contrast, the forecast of global rice production in 2021 has been revised up slightly

.

.

In contrast, the forecast of global rice production in 2021 has been revised up slightly

.

The forecast of global cereal consumption for 2021/22 is revised down by 15 million tons from the previous month to 2.

81 billion tons, but it is still 1.

5% higher than the 2020/21 season

.

81 billion tons, but it is still 1.

5% higher than the 2020/21 season

.

Global cereal stocks in 2021/22 will be higher than the initial stock levels for the first time since 2017/18

.

The increase in China's corn ending stocks is the main reason for the increase in global grain stocks this month

.

.

The increase in China's corn ending stocks is the main reason for the increase in global grain stocks this month

.