The top 10-year sales of chemical injection exceed 3 billion yuan. Who can break through 21 class 1 "new drugs"?

-

Last Update: 2018-04-02

-

Source: Internet

-

Author: User

Search more information of high quality chemicals, good prices and reliable suppliers, visit

www.echemi.com

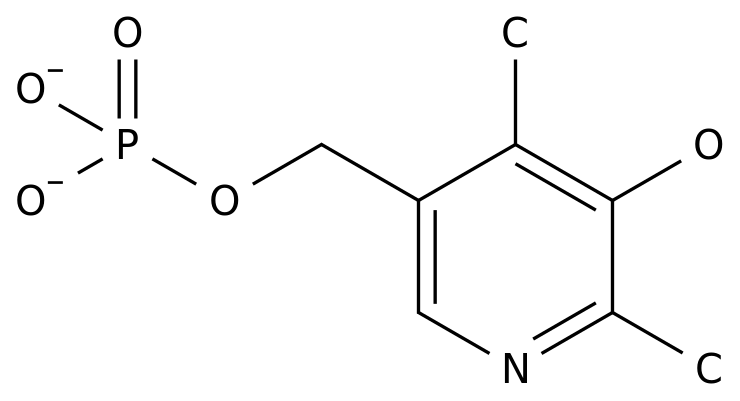

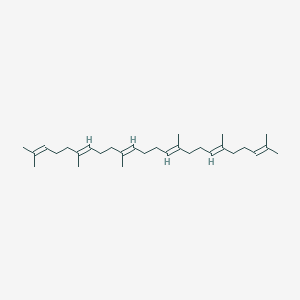

Recently, the drug evaluation center (CDE) of the State Food and Drug Administration issued the technical guidance on drug injection research and development, which is applicable to chemical injection and biological product injection, not traditional Chinese medicine injection In addition, it is clear that the R & D Application of injections should be strictly regulated, which means that a large number of injections may not get "birth paper" in the future In recent years, the injection has been attracting more and more attention What's the current market pattern of injection? What kind of change will it face in the future? What kind of chemical injection will be approved for listing in the future? Let's have a look none="shifuMouseDownStyle('shifu_bus_002')" style="margin: 1em auto; padding: 0px; max-width: 100%; color: rgb(62, 62, 62); font-family: "Hiragino Sans GB", "Microsoft YaHei", Arial, sans-serif; font-size: 16px; line-height: 25.6px; widows: 1; border-style: none none solid; text-align: center; border-bottom-width: 1px; border-bottom-color: rgb(0, 0, 0); box-sizing: border-box !im portant; word-wrap: break-word !im portant; "> the market of injection exceeds 600 billion yuan, and chemical injection plays a leading role Table 1: Top 5 of terminal chemical drugs and Chinese patent medicine dosage forms of public medical institutions in China in 2016 (source: minnei.com, terminal competition pattern of public medical institutions in China) In recent years, although the implementation of policies such as consistency evaluation, limited transportation and resistance order has certain impact on the use of injection, the overall injection Market in China still shows a rapid development trend According to the data of mienei.com, in 2016, the total amount of terminal injections used in China's urban public hospitals, county-level public hospitals, urban community centers and township hospitals (referred to as China's public medical institutions) reached 665.7 billion yuan, an increase of 7.71% over the previous year The market of chemical medicine and Chinese patent medicine is concentrated and Oligopolistic In chemical medicine, the five major dosage forms of injection, tablet, capsule, solution, powder / granule are divided into 96.99% of the market, of which the proportion of injection is 63.45% which is far ahead of other dosage forms In Chinese patent medicine, the five major dosage forms of injection, capsule, tablet, powder / granule and solution account for 88.91% Among them, injection ranks first with 37.97% of the total Whether it is chemical medicine or Chinese patent medicine, injection is firmly on the leading position Figure 1: terminal injection pattern of public medical institutions in China in 2016 (source: minenet terminal competition pattern of public medical institutions in China) The total injection Market is over 600 billion yuan, and the sales volume of chemical injection is 560.9 billion yuan, an increase of 7.71% compared with the previous year, accounting for 84%, while the sales volume of traditional Chinese medicine injection is 104.8 billion yuan, an increase of 7.71% compared with the previous year, accounting for 16% It can be seen that chemical injection is "rolling" the traditional Chinese medicine injection with an absolute advantage none="shifuMouseDownStyle('shifu_bus_002')" style="margin: 1em auto; padding: 0px; max-width: 100%; color: rgb(62, 62, 62); font-family: "Hiragino Sans GB", "Microsoft YaHei", Arial, sans-serif; font-size: 16px; line-height: 25.6px; widows: 1; border-style: none none solid; text-align: center; border-bottom-width: 1px; border-bottom-color: rgb(0, 0, 0); box-sizing: border-box !im portant; word-wrap: break-word !im portant; "> Top 10 chemical injections, half of which are exclusive products Table 2: Top 10 terminal drug injections of public medical institutions in 2016 (source: Internet database) According to the data of Internet, in 2016, top 10 terminal drug injections of public medical institutions in China, 10 of which are medical insurance products, 5 of which are exclusive products From the perspective of market share, 10 products account for 6.69% of the whole chemical injection Market, and the market share of each product is not much different It can be seen that the chemical injection Market is in a low concentration competitive pattern, with fierce competition Figure 2: Top 10 product categories of China's public medical institutions' terminal drug injection in 2016 (source: minenet China's public medical institutions' terminal competition pattern) Ten products cover nervous system drugs, systemic anti infective drugs, digestive system and metabolic drugs, cardiovascular system drugs, blood and hematopoiesis system drugs and other fields, among which four products are nervous system drugs, ranking first with a proportion of 40%, with a total sales volume of 14.729 billion yuan There are two systemic anti infective drugs, digestive system and metabolic drugs, ranking second, accounting for 20% respectively The annual sales of 10 products are more than 3 billion yuan, and there are two products with more than 4 billion yuan, namely, compound coenzyme for injection and ceftazidime for injection The annual sales of compound coenzyme for injection reached 4.323 billion yuan, ranking first with a market share of 0.77%; the annual sales of ceftazidime for injection was 4.055 billion yuan, with a market share of 0.72%; the fourth ranking dizosin injection increased by 27.13% year on year, with the highest growth rate in the top 10 products; The fifth ranked aspartic insulin 30 injection and the seventh ranked spermatin biosynthesis human insulin injection (premixed 30R) are products of Novo Nordisk Figure 3: in 2016, top 20 (source: minernet China public medical institutions terminal competition pattern) of Chinese public medical institutions terminal cardiovascular system brand for injection composite coenzyme, trade name is beconone / xinbeco, the exclusive variety of Beijing Shuanglu pharmaceutical industry, entered 2017 edition to supplement class B medical insurance The compound coenzyme for injection can be used in acute and chronic hepatitis, primary thrombocytopenic purpura, leukopenia and thrombocytopenia caused by chemotherapy and radiotherapy; it has certain auxiliary treatment effect on coronary arteriosclerosis, chronic arteritis, myocardial infarction, oliguria caused by renal insufficiency, uremia, etc According to the data of minenet, in 2016, among the top 20 brands of cardiovascular system in public medical institutions in China, coenzyme for injection ranked second with a proportion of 4.09% According to the annual report data of Shuanglu pharmaceutical in 2017, as the company's main product, compound coenzyme for injection brought a profit of 342 million yuan in 2017, with a gross profit margin of 58.59% However, affected by domestic policies such as restrictions on auxiliary drugs, the company's sales volume of biochemical drugs dropped by 28%, fortunately, the change of marketing mode still increased the sales volume of products by more than 20% However, with the first marketing of lenalidomide in China in 2018, the situation that Shuanglu pharmaceutical is the only product in the industry is likely to be broken, and lenalidomide may become a new turning point of the company's performance Figure 4: in 2016, ceftazidime for injection, the top 20 brand of anti infective drugs for general use in China's public medical institutions (source: minernet China's public medical institutions terminal competition pattern), was mainly used for septicemia, lower respiratory tract infection, abdominal cavity and biliary tract infection, complex urinary tract infection and severe skin and soft tissue infection caused by sensitive gram-negative bacilli Ceftazidime for injection is the heavyweight product of Hainan hailinghua drug, which is a national class B medical insurance drug, in which 1.0g and 0.5g ceftazidime for injection are the base drugs According to minenet data, in 2016, ceftazidime for injection ranked first among the top 20 brands of systemic anti infective drugs for terminals in public medical institutions in China with a proportion of 2.19% Figure 5: 2016 top 20 brands of terminal digestive system and metabolic drugs in China's public medical institutions (source: minenet China's public medical institutions terminal competition pattern) aspartic insulin 30 injection (trade name: novorex), protamine biosynthesis human insulin injection (premixed 30R) (trade name: novorex) All of them are exclusive products of Novo Nordisk and can be used to treat diabetes They are all medical insurance class B products, basic drugs and consistency evaluation varieties Novo Nordisk is a global leading enterprise in the prevention and treatment of diabetes Its main products are diabetes drugs, of which over 100 million products are 6 According to the data of mienei.com, in 2016, among the top 20 brands of terminal digestive system and metabolic drugs in China's public medical institutions, the second and third place were the arginine biosynthesis human insulin injection (premixed 30R) and the aspart insulin 30 injection with the proportion of 2.44% and 2.23%, respectively none="shifuMouseDownStyle('shifu_bus_002')" style="margin: 1em auto; padding: 0px; max-width: 100%; color: rgb(62, 62, 62); font-family: "Hiragino Sans GB", "Microsoft YaHei", Arial, sans-serif; font-size: 16px; line-height: 25.6px; widows: 1; border-style: none none solid; text-align: center; border-bottom-width: 1px; Border bottom color: rgb (0, 0, 0); box sizing: border box! Im portant; word wrap: break word! Im portant; "> the opinions issued by standardized R & D application, chemical injection or hard to find" birth paper "CDE are clear, and the R & D Application of injection should be standardized from the perspective of clinical effect: (1) oral administration is preferred from the perspective of R & D, followed by injection type; The injection type is prior to intramuscular injection, followed by intravenous injection and so on; (2) from the perspective of clinical value, standardize the injection to change the dosage form It should have obvious clinical advantages for the development of modified specifications, dosage forms and base injections It is more difficult to apply for injection research and development, and further control the use of injection in clinical practice In the future, a large number of injection may be "strangled" in clinical stage, and cannot be approved for listing The injection market may usher in a new round of integration Table 3: approved clinical class 1 Chemical Injection in 2017 (source: medchina drug review database 2.0 of minenet) According to midnet Med China drug review database 2.0 in 2017, there were 24 chemical injections applied for clinical application and approved as class 1 new drugs (calculated by acceptance number), involving 21 products, including 12 anti-tumor and immunomodulators, 5 nervous system drugs, 2 musculoskeletal system drugs, and 1 systemic anti infective drug It can be seen that anti-tumor and immunomodulators are the key layout of pharmaceutical enterprises Products Cx13-608 for injection is a new generation of proteasome inhibitor as a new anti-tumor targeting drug; ceftriadimeform sodium for injection is the only successful approved clinical class 1.1 new drug in recent 20 years in China It is understood that ceftriadimeform sodium is a new compound obtained from the infrastructure transformation of ceftriadimeform, the only innovative drug developed by Chinese people, which is in the pioneering position in China; Shr8554 injection and morphine-6-glucoside acid injection are all analgesic drugs, but there is no similar drug in clinical research stage or on the market in China; apg-1387 for injection, an anticancer drug targeting IAP protein, is currently in the development stage of similar products in the world; fns007 for injection, the first rheumatoid arthritis treatment drug aiming at the pathogenesis (antigen) How many of the 21 chemical injections applied for clinical application and approved in 2017 can be successfully listed on the "birth paper" given by CFDA? Let's wait and see! Data source: minenet database, annual report and announcement of listed companies, CDE official website, etc

This article is an English version of an article which is originally in the Chinese language on echemi.com and is provided for information purposes only.

This website makes no representation or warranty of any kind, either expressed or implied, as to the accuracy, completeness ownership or reliability of

the article or any translations thereof. If you have any concerns or complaints relating to the article, please send an email, providing a detailed

description of the concern or complaint, to

service@echemi.com. A staff member will contact you within 5 working days. Once verified, infringing content

will be removed immediately.