What are the strong competitors of domestic generic drugs in 2018?

-

Last Update: 2018-03-04

-

Source: Internet

-

Author: User

Search more information of high quality chemicals, good prices and reliable suppliers, visit

www.echemi.com

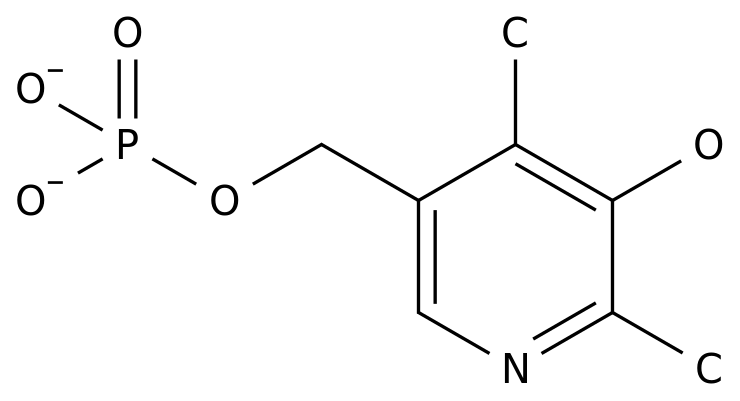

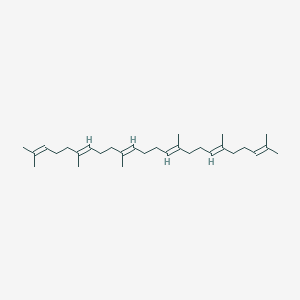

In 2017, the blowout of class 1 new drugs was "not surprising" However, the follow-up of class 1 new drugs is generic drugs In this issue, Xiaobian will lead you to see which generic drugs submitted in 2017 will meet the market competitors Data source: CDE website, aimec national sample public hospital database screening criteria: drugs with application type of "imitation" submitted in 2017 First, take a look at the top 10 drug names applied by CDE enterprises in 2017 (only based on preparations), and the small edition will display the names of more than three competitive enterprises These enterprises on the way, if successful, will become strong competitors in the market for share Tenofovir disoproxil fumarate tablets 5 enterprise groups submitted the application, which is suitable for the combination with other antiretroviral drugs to treat HIV-1 infection in adults It can also be used to treat adult chronic hepatitis B (HBV) infection In 2017, a total of 5 enterprise groups submitted generic drug listing applications for tenofovir dipivoxil fumarate tablets, which have not been included in the priority review list However, four generic drugs applied for by Anhui Baker United Pharmaceutical Co., Ltd have been approved, and the listing is just around the corner It took eight months, which is a normal speed, right? Of course, this is only the application of CDE generic drugs in 2017, and there are many companies that are doing clinical trials In 2017, there were 14 enterprises registered in CDE to carry out clinical trials, 9 of which have completed clinical trials That is to say, in the future, there will be at least ten manufacturers competing in the market for tenofovir dipivoxil fumarate tablets How big is the cake in the market? In the national sample public hospital database of aimec, the total purchase amount of tenofovir / dipivoxil reached 190 million yuan in the first three quarters of 2017, nearly three times higher than the total purchase amount in 2015, with huge market potential However, no matter how big the cake is, it can't hold many people, so there won't be many points In 2017, in the sample hospitals, the original research geelide accounted for 98% of the share, and other generic drugs can only share a little bread crumb Under the promotion of consistency evaluation, if the original research and imitation can be treated equally in the bidding process, then price and market promotion will become one of the important factors to compete for market share Are the guys' sales teams ready? Five enterprise groups of moxifloxacin hydrochloride tablets submitted applications for moxifloxacin in the treatment of adult (≥ 18 years old) sensitive bacteria caused by upper and lower respiratory tract infection, acute sinusitis, acute attack of chronic bronchitis, community-acquired pneumonia, and skin and soft tissue infection In 2017, the generic drug listing application of moxifloxacin hydrochloride tablets submitted by five enterprise groups was undertaken by CFDA Among them, moxifloxacin hydrochloride tablets applied by Guangdong dongyangguang Pharmaceutical Co., Ltd were publicized on December 18, 2017 and included in the priority review list, and are still under review and approval In the public list of CDE clinical registration, only three enterprises registered moxifloxacin hydrochloride tablets in 2017, two of which have completed the be test, and it is believed that the application for generic drug listing will also be submitted soon The market competition of moxifloxacin hydrochloride tablets is also about to turn white hot At this time, pour cold water on the small preparation With the most strict anti orders and the continuous promotion of drug proportion, the growth of antibiotics has been limited to a certain extent Taking the generic name moxifloxacin as an example, compared with the data in 2015 and 2016, the total drug purchase amount of sample hospitals decreased from 2.044 billion yuan to 1.453 billion yuan, down nearly 30% In the first three quarters of 2017, the total drug purchase amount was 1.279 billion yuan However, the skinny camel is bigger than the horse Who let the market capacity of moxifloxacin lie here! The amount of porridge is much better than the one upstairs In addition to Nanjing Youke, which has occupied the second largest share in the market, seven other enterprises are still coming Although the first three enterprises that pass the consistency evaluation will get the inclination of the bidding policy, if the fourth and fifth six enterprises pass almost at the same time, they will still face fierce competition, with no less than price, promotion and clinical cultivation Gefitinib, one of the five enterprise groups applying for gefitinib, negotiated to reduce its price and enter the medical insurance in 2016 Even so, there are still many enterprises behind it Only in 2017, there are five enterprise groups applying for the listing of generic drugs, which are currently under review and approval In the CDE clinical trial registration list, in 2017, there were nearly ten enterprises carrying out clinical trial registration, four of which have completed the be test, and three have submitted the generic drug listing application (as shown in the above figure) In 2016, gefitinib negotiated a price cut, which almost halved its market growth In 2015, the total amount of drugs purchased by sample hospitals was about 700 million yuan, and in 2016 it was only 350 million yuan Even so, in the first three quarters of 2017, it also reached the total amount of drugs purchased in 2016, which to a certain extent indicates that the volume of medical insurance began gradually Looking at the gefitinib generic drugs, the gefitinib of Qilu pharmaceutical was approved to be listed at the end of 2016 In 2017, it occupied 9% of AstraZeneca's market share, which was very fast It seems that in the short term, there will be at least five generic drugs on the market, which is absolutely good news for patients, but for enterprises, how to highlight the encirclement in the environment of consistency evaluation is an important work to be considered Four enterprise groups of viagliptin tablets submitted applications for the application of viagliptin tablets for the treatment of type 2 diabetes: when diet and exercise can not effectively control blood sugar, this product can be used as a single drug treatment, or when metformin as a single drug treatment can not effectively control blood sugar until the maximum tolerable dose, this product can be used in combination with metformin (small Edition: originally used to cover the bottom, so the sales volume is dangerous...) in 2017, four enterprise groups submitted generic drug listing applications, which are currently under review and approval Let's look at the registration information of clinical trials In 2017, there were 7 enterprises registered for clinical trials, four of which have completed the be trial, plus the enterprises that have applied for listing At present, 7 enterprises are qualified for listing Xiaobian thought, how many cakes in the market can stand such division? At present, in the sample public hospitals, only the original Novartis has sales manifestation In 2017, the median national bidding price was 62.13 yuan / 50mg * 14, two tablets a day, one tablet at a time, that is to say, one box will take one week Moreover, generally, diabetes drugs take a long period, for patients, the drug burden of one month is not small However, it's hard to say whether the drugs that have completed the consistency evaluation can pull the price reduction of the original research After all, the cost of drug research and development is placed in front of the enterprise It's very likely that the price of generic drugs is almost the same as that of the original research, and the final competition is market cultivation and promotion Four groups of paclitaxel for injection (albumin binding type) submitted applications for paclitaxel for injection (albumin binding type), which is suitable for the treatment of metastatic breast cancer that failed in combination chemotherapy or breast cancer that recurred within 6 months after adjuvant chemotherapy The allergic reaction rate of paclitaxel for injection (albumin binding type) is very low and does not need pretreatment Hematotoxicity, gastrointestinal toxicity and neurotoxicity were lower than those of Paclitaxel injection and paclitaxel liposome In 2017, a total of four enterprise groups submitted generic drug listing applications, among which the taxol for injection (albumin binding type) submitted by Jiangsu Hengrui was publicized in June 2017 for priority review Nevertheless, paclitaxel for injection (albumin binding type) applied by Shijiazhuang Pharmaceutical Group was approved by CFDA in February 2018 It is said that paclitaxel for injection (albumin binding type) in the original research is very expensive According to the small edition, the median bid price of paclitaxel for injection in China is 5800 yuan / 0.1g For patients with metastatic breast cancer or recurrent breast cancer after adjuvant chemotherapy who failed in combination chemotherapy, it is recommended to use 260mg / m2, intravenous infusion for 30 minutes, once every three weeks Rough calculation of the average amount of adult consumption in China is 4-5 (rough calculation, more real students please go out and turn left), that is to say, a chemotherapy costs 20000-30000 yuan, which highlights the importance of the role of generic drugs in lowering the price of the original research At present, only the paclitaxel (albumin binding type) produced by feline yuskabi is sold in the market Although the growth is slow, it is stable In the future, after the generic drugs go on the market, there may be a more fierce price war Seeing that the last thing is true love, we will review the top 10 (excluding supplementary applications) of CDE enterprises' application for common name acceptance from 2013 to 2017 From the top 10 of common name acceptance over the years, you can see which areas of drug use will face more fierce competition in the future Top 10 of CDE enterprises' application for common name acceptance in 2012-2017 (excluding supplementary application)

This article is an English version of an article which is originally in the Chinese language on echemi.com and is provided for information purposes only.

This website makes no representation or warranty of any kind, either expressed or implied, as to the accuracy, completeness ownership or reliability of

the article or any translations thereof. If you have any concerns or complaints relating to the article, please send an email, providing a detailed

description of the concern or complaint, to

service@echemi.com. A staff member will contact you within 5 working days. Once verified, infringing content

will be removed immediately.