Wu Zhong pharmaceutical's class I anticancer drug (Su Qiujia) clinical trial failed for a long time, and shareholders began to fire at the management

-

Last Update: 2015-04-25

-

Source: Internet

-

Author: User

Search more information of high quality chemicals, good prices and reliable suppliers, visit

www.echemi.com

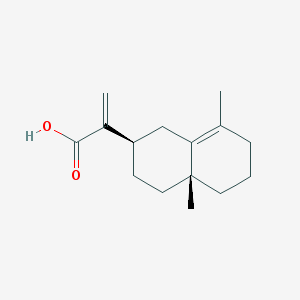

On April 17, Jiangsu Wuzhong (600200) annual general meeting of shareholders, the company is in clinical trials of a class of original anti-cancer drug research project (Su Qiujia) due to the delay can not be unblinded, some small and medium-sized shareholders have opened fire to the management, asking the company to explain to investors In the case of Su Zijia's delay in entering the market, the company's capital chain is also under test, and the asset liability ratio is still high this year On November 28 last year, Wuzhong, Jiangsu Province, announced that it planned to raise 514 million yuan more for all five pharmaceutical industry projects, of which 156 million yuan will be included in the research and development project of recombinant human endostatin injection, a class a new biological anti-cancer drug in the country However, from the exchange of the company's shareholders' meeting, up to now, Su's market is still far away Wuzhong is one of the most famous "chameleons" in A-share market In 1999, Wuzhong, Jiangsu Province completed its IPO At that time, its main business was clothing production and sales, and there were also some pharmaceutical businesses Ten years later, in 2009, the company began to gradually fade out of the clothing industry, transfer its largest Jiangsu Wuzhong clothing group, and began to enter the real estate industry Until 2013, Wuzhong's real estate business revenue reached 1.334 billion yuan, and its operating profit was 278 million yuan, ranking first in all businesses In addition to real estate, there is actually a precious metal processing business that is easy to be ignored This business is mainly operated by Suzhou Xingrui precious metal materials Co., Ltd., one of the largest and most professional potassium cyanide production enterprises in China It was purchased by Wuzhong, Jiangsu Province in 2003 The reason why it is easy to be ignored is that the profit it contributes to the listed company is really insignificant In 2013 and 2014, the gross profit rate of the business was only 0.81% and 1.25% respectively, but its revenue was as high as 1.3 billion and 1.167 billion respectively, accounting for 34% and 38% of the total revenue of that year, which greatly strengthened the revenue scale of Wuzhong, Jiangsu Province At the annual shareholders' meeting, some investors also questioned the precious metal business of "Facade", believing that it is unnecessary for the company to spend a lot of energy to maintain a business that can not bring actual benefits, but the company believes that its actual role cannot be judged from the book data According to the 2014 financial report, the company's real estate business shrank significantly, with a revenue of only 517 million yuan, which even lagged behind the international trade business, but the operating profit still reached 177 million yuan, second only to the pharmaceutical business For the sharp decline of the real estate business, the company's management explained at the shareholders' meeting that it was mainly due to the centralized carry over sales of Jinchang guarantee housing project in 2013, and the real estate business was due to the decline of the pace of commercial housing deregulation caused by market reasons, resulting in the decrease of carry over income Zhao Dui, chairman of Jiangsu Wuzhong, said in a question from the reporter of China times that the company's core business is the pharmaceutical industry, and real estate is an important source of profit, but the scale of commercial housing will definitely shrink in the future The company's real estate business will mainly focus on the protection of housing construction in the future, although the profit is lower, but the risk is smaller Due to the sharp decline of the real estate business, the precious metal processing business of the company became the largest main business again last year However, although the pharmaceutical business ranked second with revenue of 729 million yuan, its operating profit reached 265 million yuan, becoming the largest profit source of the company However, according to the three-year strategic planning outline (2014-2016) issued by Wuzhong last April, the company has established a development framework with medicine as the core industry and real estate as the important industry In 2016, the company plans to achieve a medical operating revenue of 1.8 billion yuan, 2.5 times the scale in 2014 To achieve this goal, the company will rely on Su Cijia, who is in clinical trials "The company has announced every time that the clinical trial of new drugs has been progressing smoothly, but it has not produced results in the past four years I hope the company can explain this problem positively." In the question section of the annual shareholders' meeting, a shareholder first challenged the company's management, and this question also resonated with other small shareholders attending the meeting, so that the new drug question occupied the majority of the question time According to the company's historical announcement, susijia, developed by Wuzhong, Jiangsu Province, is a national class I new biological anticancer drug with the full name of "recombinant human endostatin injection" On February 28, 2011, Su Qiujia was informed by the State Food and drug administration that it was approved to enter the third phase of clinical work The third phase of clinical work plan of the product has been fully launched since March 2011 The company originally expected to complete the third phase of clinical research of the product in about two years Because susija has a wide spectrum, can adapt to all kinds of cancer patients, and has exact curative effect, almost no antibody, which has aroused great attention in the market, and investors also have great expectations for it The reporter of China Times found that since 2011, in the first half of every year, the stock price of Wuzhong in Jiangsu Province has been at the peak of speculation Since February this year, the highest increase of the stock price has been nearly 90% On April 21, the stock price of Wuzhong in Jiangsu Province closed at 20.88 yuan, but in 2014, the earnings per share was only 0.065 yuan Its valuation has obviously overdrawn the benefits brought by new drugs However, until now, the phase III clinical trial of susiya has not been completed, and the company also said that the clinical trial is decided by the regulatory authority, so it is impossible to predict when the phase III trial will be completed According to the State Food and drug administration, even after the completion of the third phase of the trial, there will be no less than 2000 four phase clinical trials, and the length of the four phase trial can not be estimated There is no doubt that the patience of investors is undergoing a huge test After all, the outbreak of Chongqing beer stomach disease vaccine once made heavy beer investors lose a lot, and what worried them more is that even if this medicine can be launched, there is still doubt about how much benefit it can bring According to the information disclosed at the general meeting of shareholders and previously released to the public, by the end of 2014, the Pharmaceutical Group under the company had more than 30 kinds of research projects, including anti-tumor, immune regulation, digestive and anti infection projects, among which 6 were applied for production, 3 were in clinical stage, 4 were applying for clinical approval, and the rest were in pre clinical pharmaceutical research Stage New drug research and development is obviously a time-consuming project At the shareholders' meeting, Jiangsu Wuzhong disclosed that in 2015, the company expected to require a total of 760 million yuan for operation and project investment, including 50 million yuan for project investment, and 710 million yuan for operational reserves and working capital

This article is an English version of an article which is originally in the Chinese language on echemi.com and is provided for information purposes only.

This website makes no representation or warranty of any kind, either expressed or implied, as to the accuracy, completeness ownership or reliability of

the article or any translations thereof. If you have any concerns or complaints relating to the article, please send an email, providing a detailed

description of the concern or complaint, to

service@echemi.com. A staff member will contact you within 5 working days. Once verified, infringing content

will be removed immediately.